Prior depreciation calculator

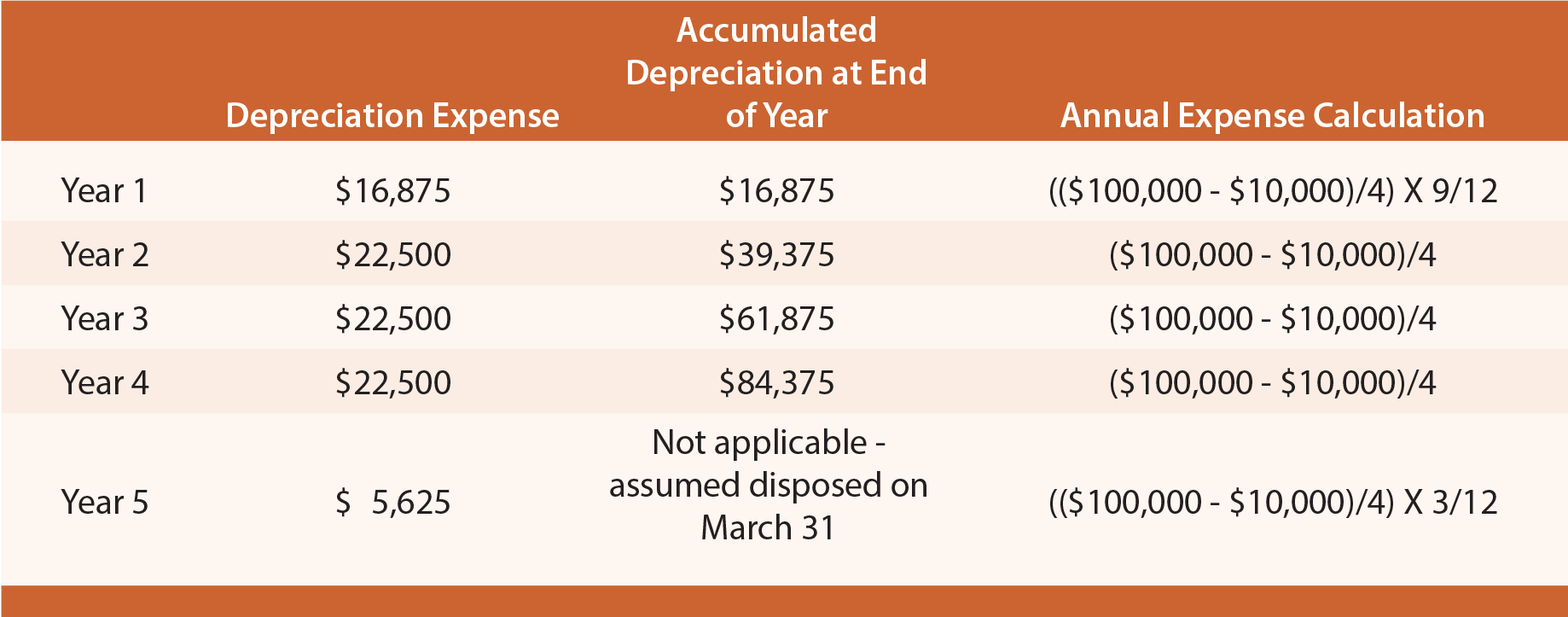

Depreciation is a method for spreading out deductions for a long-term business asset over several years. A negative section 481a adjustment results in a decrease in taxable income.

Depreciation Schedule Formula And Calculator Excel Template

After a year your cars value decreases to 81 of the initial value.

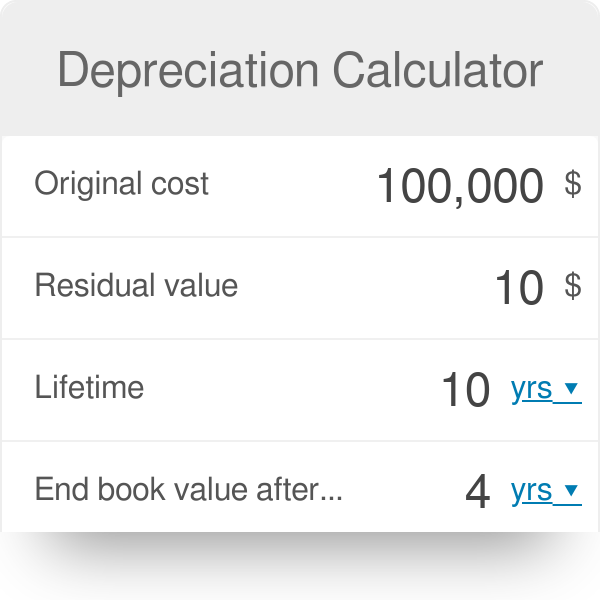

. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. It is fairly simple to use. This depreciation calculator is for calculating the depreciation schedule of an asset.

If you are in Fixed Assets CS continue to Step 2. The depreciation of an asset is spread evenly across the life. The calculator also estimates the first year and the total vehicle depreciation.

In the Prior Depreciation Comparison dialog click the tab for the desired treatment and compare the amounts displayed in the Amount on file and the Computed amount fields. Click in the Prior Depreciation field to reveal a calculator icon. First one can choose the straight line method of.

In the Prior Depreciation Comparison panel you can change the. If this is the first year you have offered the property as a rental and have never taken depreciation in a prior tax year the value of Prior. Also includes a specialized real estate property calculator.

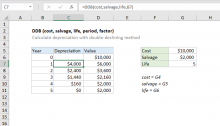

Where Di is the depreciation in year i. The MACRS Depreciation Calculator uses the following basic formula. Our car depreciation calculator uses the following values source.

D i C R i. June 4 2019 641 PM. If you are in UltraTax CS open the Asset tab.

The straight line calculation as the name suggests is a straight line drop in asset value. If no depreciation was deducted the adjustment is the total depreciation allowable prior to the year of change. To calculate prior depreciation for multiple assets follow the steps below.

It provides a couple different methods of depreciation. It includes support for qualified and listed assets including motor. This MACRS Depreciation Calculator supports nearly all the nuances and conventions of the Internal Revenue Code.

The calculation is based on the Modified Accelerated Cost Recovery method as described. The basic way to calculate depreciation is to take the. After two years your cars value.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Uses mid month convention and straight-line. Select the currency from the drop-down list optional Enter the.

Click this icon to open the Prior Depreciation Comparison. This calculator will calculate the rate and expense amount for personal or real property for a given year. All you need to do is.

Since you used the mileage allowance in previous years you would multiply your business miles in 2020 by 027. 1 Best answer. You would have to calculate the depreciation figures.

C is the original purchase price or basis of an asset.

Depreciation Calculator Definition Formula

Depreciation Schedule Formula And Calculator Excel Template

Skzi1zpptvapjm

Double Declining Balance Depreciation Calculator

Declining Balance Method Of Depreciation Formula Depreciation Guru

Macrs Depreciation Calculator Straight Line Double Declining

Dax Financial Functions Depreciation Calculations Simple Talk

Free Macrs Depreciation Calculator For Excel

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Straight Line Double Declining

How To Use The Excel Db Function Exceljet

How To Use The Excel Db Function Exceljet

Depreciation Schedule Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Methods Principlesofaccounting Com

Straight Line Depreciation Calculator With Printable Schedule

Macrs Depreciation Calculator Irs Publication 946